NOTE: We’re going to be raising our membership prices across all tiers very soon.

Monthly would increase from $30 to either $35 or $40.

Yearly would increase from $240 to $350.

Founding Member (with Discord access) would increase from $600 to $800.

If you want to secure our current pricing with a guarantee to always get that price throughout your membership (irrespective of any further price increases), then now would be the perfect time to do it!

In technical analysis, the Relative Strength Index (RSI) is a mainstay among traders who seek to spot profitable inflection points in price trends.

This is a pattern setup we often use, especially for Cryptos and Commodities.

With the confluence of other technical indicators, these divergences can have quite a high success rate.

Divergence occurs when the price of an asset moves in the opposite direction of a technical indicator.

In the case of RSI, it is a powerful signal suggesting either a potential trend reversal (regular RSI divergences) or trend continuation (hidden RSI divergences).

This article dives into 4 types of RSI divergence:

Bullish RSI Divergence

Bearish RSI Divergence

Hidden Bullish RSI Divergence

Hidden Bearish RSI Divergence

1. Bullish RSI Divergence (Bullish Reversal)

Bullish RSI Divergence signals that the current downtrend may be weakening and a bullish trend reversal to the upside is in the making.

It occurs when price makes a lower low, but the RSI makes a higher low.

This indicates less downward momentum, suggesting that the sellers are getting exhausted, and a trend reversal to the upside is likely.

It’s important to remember that multiple drives of bullish RSI divergence can be formed if price makes lower lows more than once, but the RSI consistently makes a higher low.

2. Bearish RSI Divergence (Bearish Reversal)

Bearish RSI Divergence signals that an uptrend may be running out of steam and could reverse to the downside.

This form of divergence occurs when the price makes a higher high, but the RSI makes a lower high.

This divergence can be an early warning that while prices are climbing, the upward momentum is weakening.

Remember, like multiple drives of bullish RSI divergence, there can also be multiple drives of bearish RSI divergence as price makes more than one higher high, while the RSI continues to make lower highs.

In our Premium Section next we’ll cover Hidden Bullish RSI Divergence and Hidden Bearish RSI Divergence.

These are both trend continuation signals, which are helpful to maximize profits!

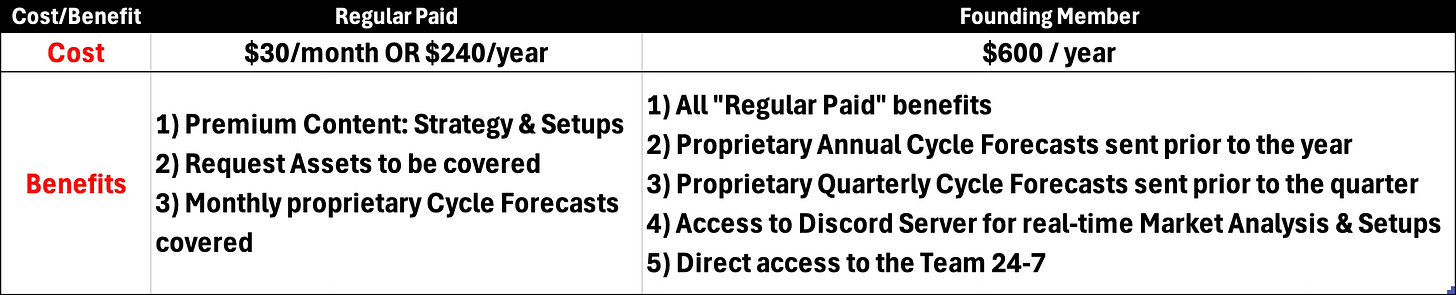

Find our membership cost/benefits below. If you’re serious about Making Money (our primary goal at Cycles Edge), then the Premium Sections are key for you!

NOTE: We’re going to be raising our membership prices across all tiers very soon.

Monthly would increase from $30 to either $35 or $40.

Yearly would increase from $240 to $350.

Founding Member would increase from $600 to $800.

If you want to secure our current pricing with a guarantee to always get that price throughout your membership (irrespective of any further price increases), then now would be the perfect time to do it!